|

October - December 2001 |

Aïshti boutique held its grand opening on December 7. The new department store is situated at 71 Moutran street. More than 50 well-known brands are available on four floors, covering cosmetics, jewellery, menswear, ladies fashion, shoes, accessories, children's wear, lingerie and sportswear. Two upper floors, expected to open in March 2002, will include a restaurant and a beauty treatment spa.

Other retail openings

Action

Sport

Aspuces

Aziz

delicatessen

Citrus

fusion

cuisine

De

Castellane

gifts

Diva

Bar

Di

Maggio

café

Don

Eduardo

steak

house

Dunkin

Donuts

Florsheim

shoes

Goofy

gifts

Grimani

handbags

Gucci

Island

Butterfly

chocolates

Kindara

shoes

Kiub's

restaurant

La

Posta

restaurant

Le

5

brasserie

La

Maison

du

Saumon-Salmontini

Liquid

bar

Mabrouk

artisanat

St

Vincent

de

Paul

Mahfouz

fashions

Momento

computers

Morgan

clothing

Nabil

Ammache

&

Salon

Isis

Petit

Café

Pizzazz

famous

pizza

Prémaman

children's

wear

Prima

Luce

restaurant

Pulse

bar

Ramzi

Zeidan

&

Co

jewellers

Rectangle

Jaune

clothing

Rosana

restaurant

Safadi

snack

Springfield

clothing

Swarovski

crystalware

Scoozi

restaurant

Strange

Fruit

nightclub

Tant

qu'il

y

aura

des

femmes

lingerie

Timberland

clothing

Tod's

shoes

&

bags

3

pas

children's

shoes

Zone

gadgets

Moving in soon

Bacalao

Spanish

restaurant

Body

One

lingerie

Façonnable

clothing

Geoffrey's

café

Kababji

restaurant

Ladurée

restaurant

La

Camiceria

Italiana

Les

Deux

Magots

restaurant

Mahmoud

Kabalan

carpets

Nakhlé

ladies

fashion

O

mi-centre

snack

Paper

Moon

coffee

shop

Paul

coffee

shop

San

Raphael

beauty

institute

Wardé

furnishing

fabrics

Offices

Parsons Brickerhoff engineers and planners, headquartered in New York, have moved their Lebanese operations to Astral building Maarad street.

Other newcomers include: Lido Master, representing Universal for music, at 157 Saad Zaghloul street; Fidus financial services at 1166 Riad El Solh Street; Siemens at 200 Hussein El Ahdab street; Intermarkets advertising at 201 Maarad street; and Pharaon Holding at Asseily building, Riad El Solh Square.

Hotels

Marina

Towers

foundation

stone

On

October

30,

Prime

Minister

Rafic

Hariri

placed

the

foundation

stone

for

the

Marina

Towers

project,

in

the

presence

of

the

Marina

Towers

s.a.l

board

of

directors,

and

many

guests.

The

luxury

residential

complex

overlooking

the

Beirut

Marina

consists

of

a

150-meter

tower

incorporating

31

storeys,

and

another

nine-storey

building.

Based

on

a

concept

by

Kohn

Pedersen

Fox

Associates

(USA),

the

design

was

implemented

by

Buro

Happold

(UK).

Solidere published its audited half-yearly financial statements. The results show a loss of US$4.3 million, mostly due to delays in closing sales, as the impact of decree 5714 of June 19, 2001 amending the master plan had not been felt by mid-year. Sales revenues were US$9.5 million, rental revenues US$4.8 million. Despite the poor results, the Company fulfilled its financial commitments, including a debt repayment of US$11 million. The Company expects to have substantially improved results by year-end.

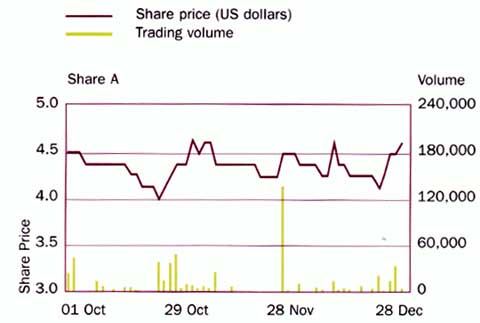

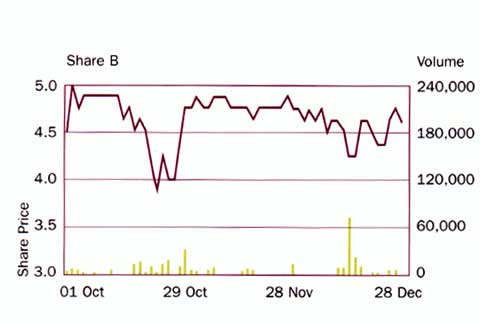

The quarter started with a worsening of the downward drift after the US events. By end October, share A moved back to its low of US$4 and share B reached a new low of US$37/8. November witnessed a reversal and the positive mood was boosted beginning December by two large Special Orders: 500,000 A shares and 500,000 B shares were traded off the market floor at a US$5 price.

Share A closed the quarter at US$45/8, 2.8% higher than the previous quarter. Share B closed slightly upbeat, also at US$45/8, 2.8% above the previous quarter.

Trading activity turned higher, with around 1,975,550 shares exchanging hands.

The GDRs, which are traded in the London Stock Exchange, also moved higher during the quarter, closing at $43/8.